Gold hits record high, Bitcoin tops $110K as traders raise bets on Fed cuts

Key Takeaways

- Gold reached a record $3,508 and Bitcoin topped $110,000 as traders expect the central bank to lower interest rates in September.

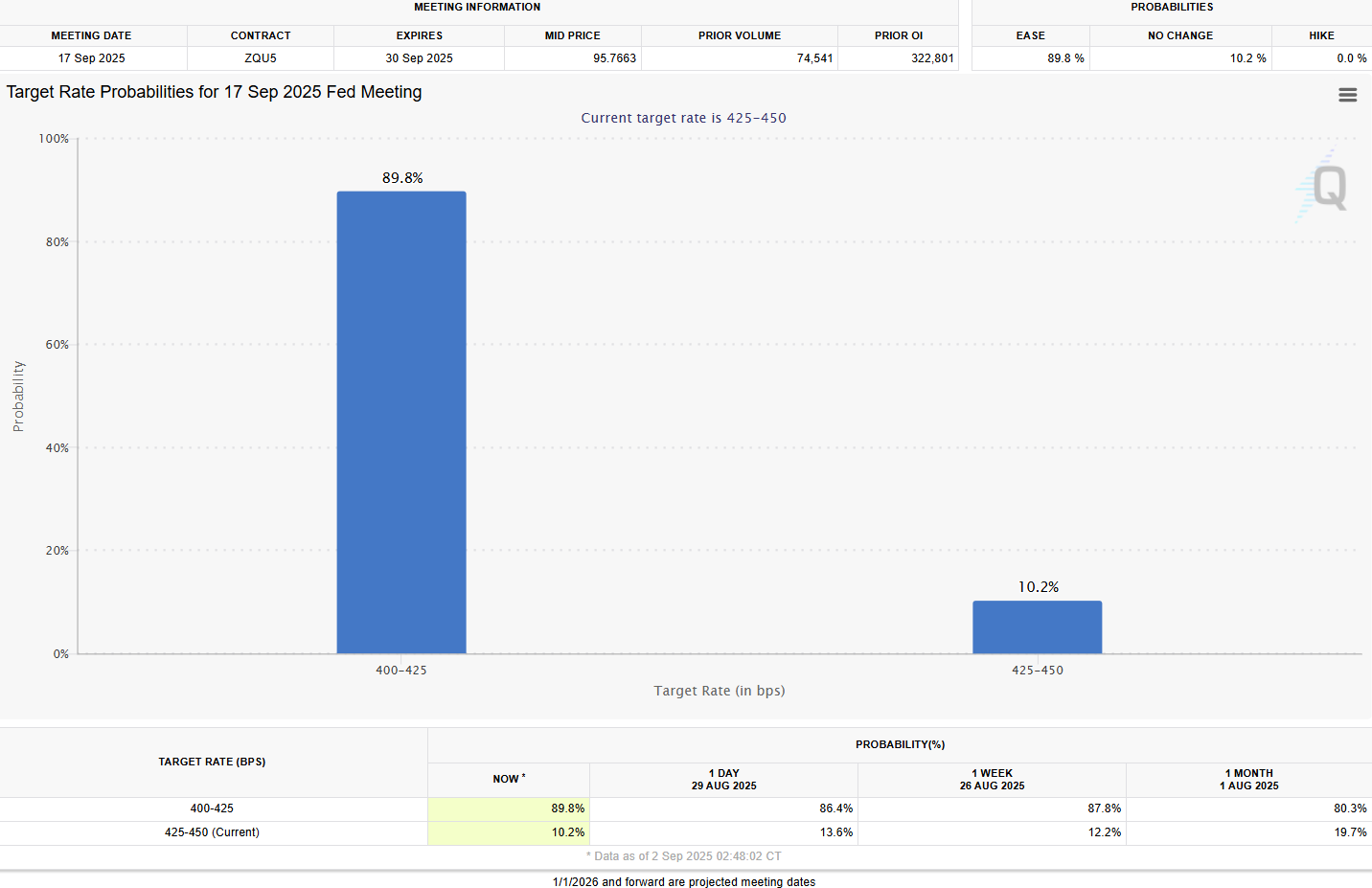

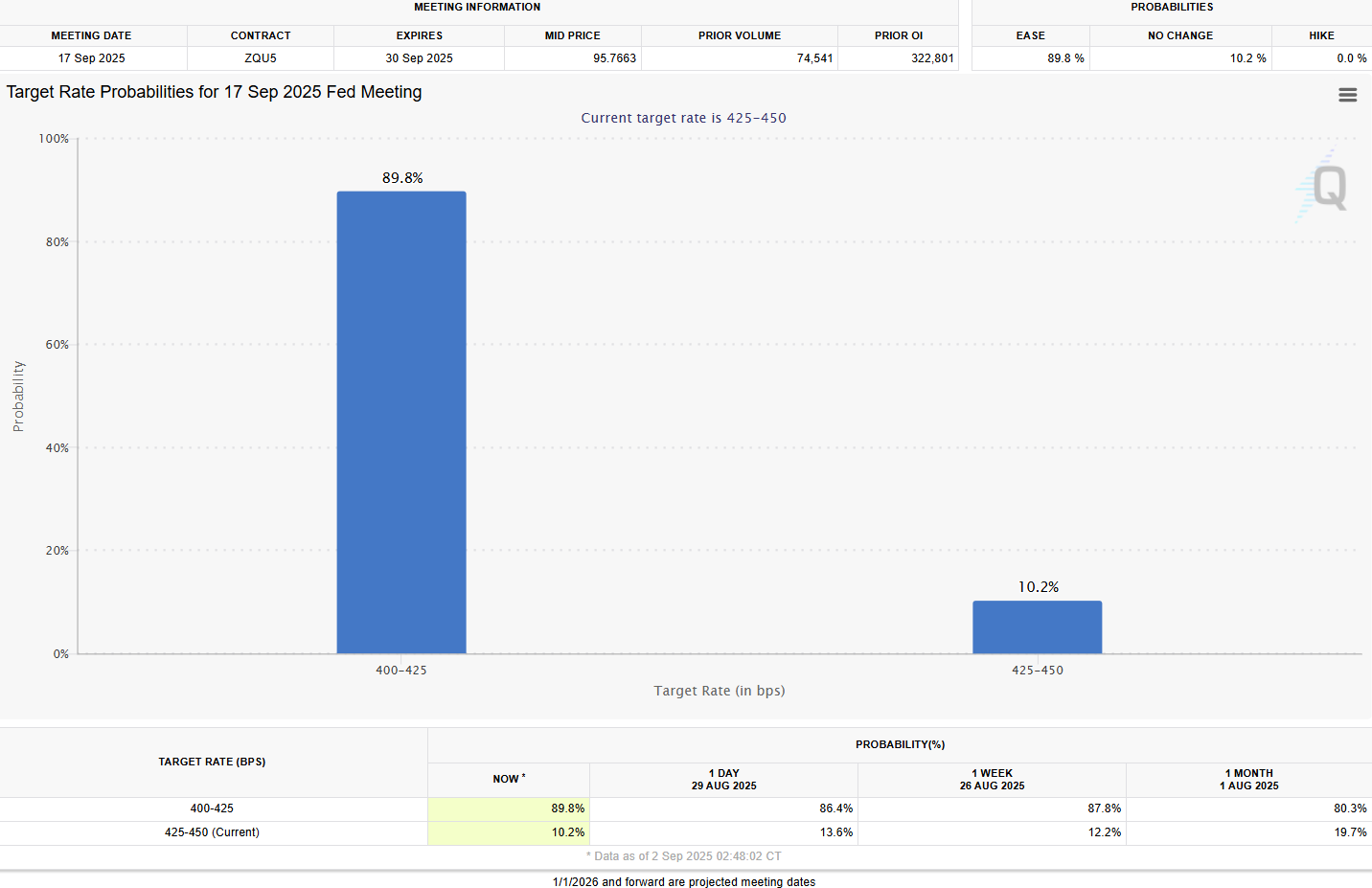

- Crypto and gold markets surged, driven by a nearly 90% probability traders assign to an imminent Fed rate reduction.

Share this article

Gold notched a fresh high of $3,508 in Asian trading on Tuesday, while Bitcoin surpassed $110,000 amid growing bets the Federal Reserve will cut rates at its upcoming September 17 meeting.

According to the FedWatch Tool, the probability of a quarter-point reduction has climbed to nearly 90%, up from 86% yesterday and 84% last week. The odds were last at this level on August 22, after Fed Chair Jerome Powell signaled that a cut could be on the table.

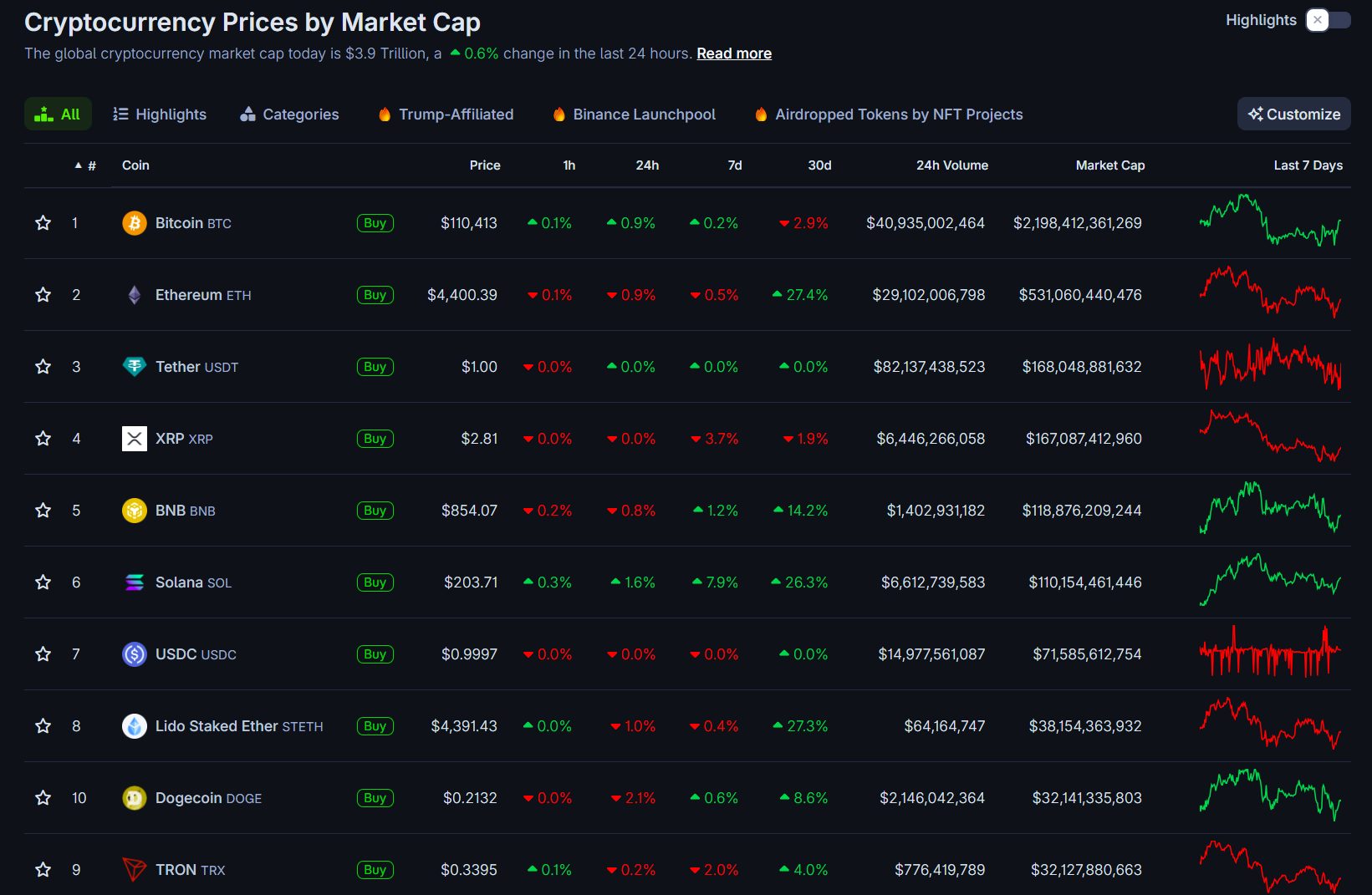

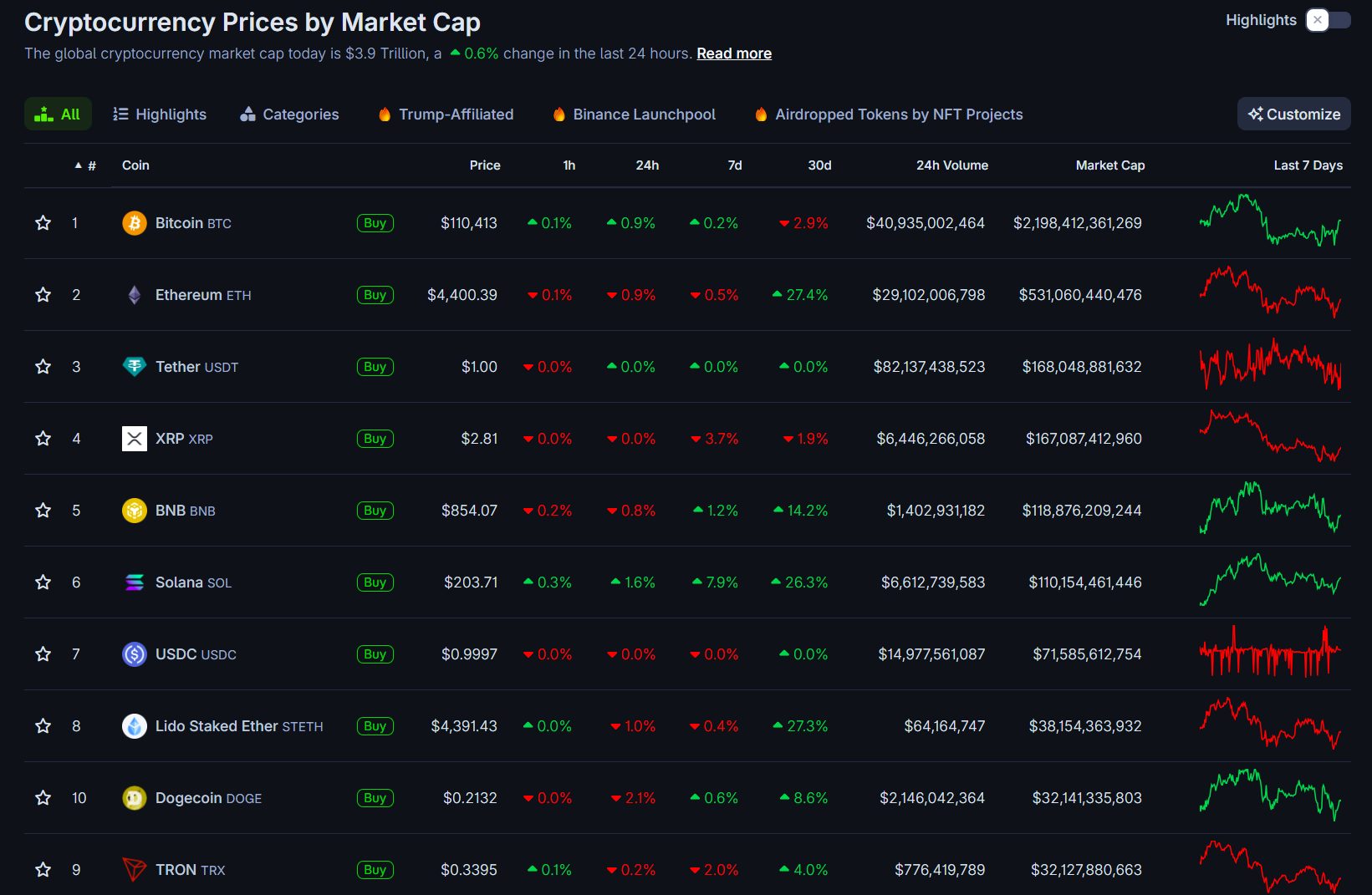

Bitcoin climbed from $107,500 to $110,500, lifting other crypto assets. Ethereum reclaimed $4,400, Solana traded back above $200, and other major tokens also advanced.

Total crypto market capitalization surged to $3.9 trillion, up slightly in the last 24 hours.

Analyst MacroScope views gold’s breakout as a bullish macro signal for Bitcoin. In April, when gold surged, Bitcoin briefly pulled back from $109,000 to $75,000 before diverging from other risk assets and soaring to record highs.

The analyst sees signs of a repeat pattern, with Bitcoin possibly dipping in the short term before staging another strong rally.

“Gold is screaming to be long BTC once this BTC retracement is done,” said MacroScope in a statement. “The last time this happened was below in April. Gold had just made a huge move to the 3400-3500 area. During that same time, BTC retraced from 109k to 75k.”

“The inflection point was a positive divergence by BTC from risk assets. BTC then ran to new highs. Current timing unknown. And maybe a different inflection point. We’ll see,” the analyst added.

Investors are awaiting a series of US economic releases that could sharpen expectations of Fed policy. The focus this week is on the August jobs report, the first full read on labor conditions since July’s revisions revealed weaker job growth than initially reported.

The August inflation print, scheduled for September 11, could further confirm whether rate cuts are imminent.

Beyond the numbers, investors are also keeping an eye on the ongoing legal and political developments at the Fed, including the Senate Banking Committee hearing for Stephen Miran, Trump’s nominee to the Fed Board, and the unresolved case of Fed governor Lisa Cook.

Share this article